E-Invoice from Tally Prime For Nigeria: A Practical Guide for Indian Businesses

E-Invoice from Tally Prime For Nigeria: A Practical Guide for Indian Businesses

Problem-Led Introduction

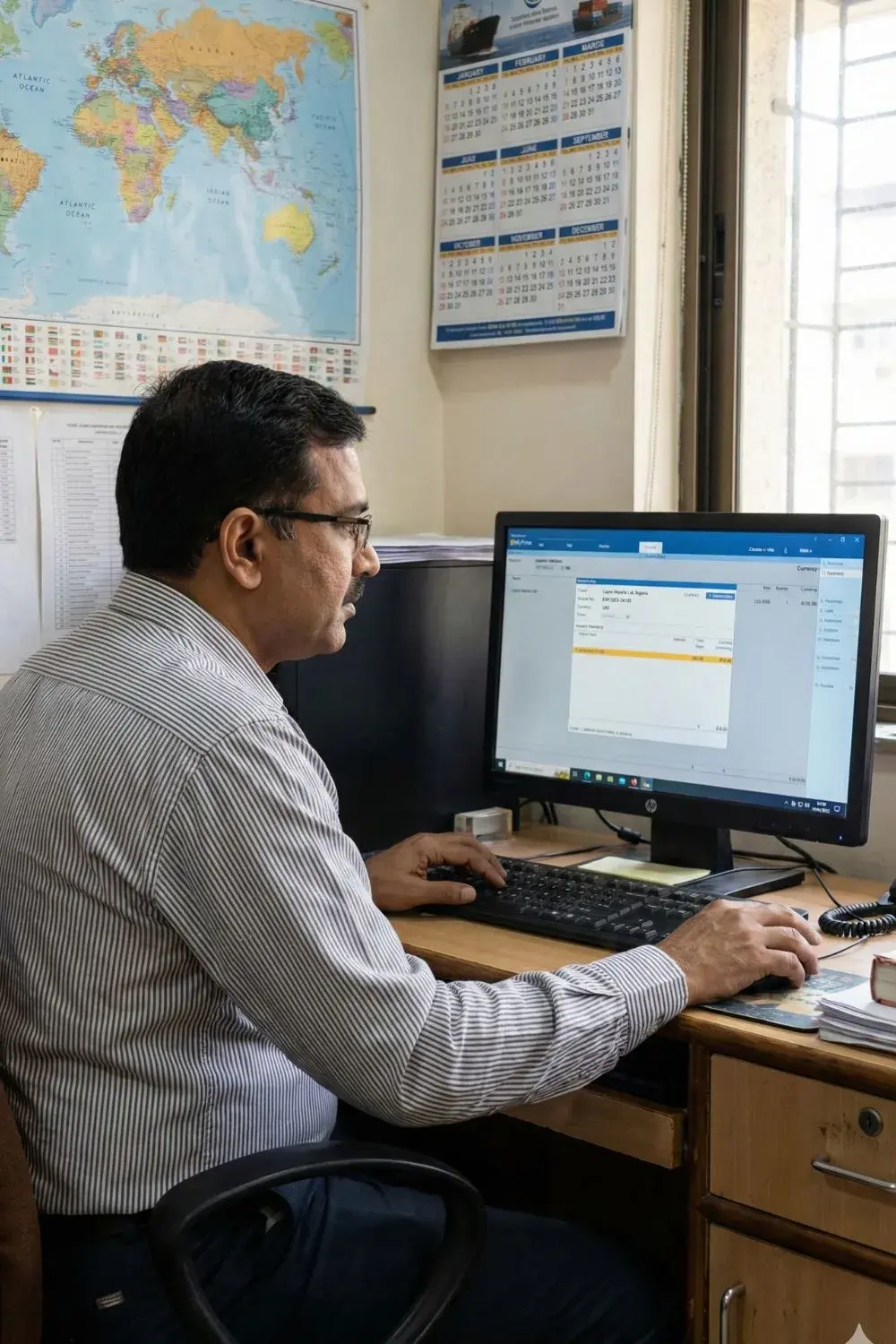

Indian exporters dealing with Nigeria often manage invoices in multiple currencies, export documentation, GST compliance, and foreign customer requirements at the same time.

Many businesses still prepare export invoices manually, track exchange rates separately, and then re-enter data into Tally for accounting and GST reporting. This creates duplication, reporting delays, and confusion when cancellations or corrections are required.

As export volumes increase in 2025, this manual workflow becomes risky and expensive.

This is where E-Invoice from Tally Prime for Nigeria becomes important.

2. What This Service Is & Why It Matters for Indian SMEs

E-Invoice from Tally Prime for Nigeria allows Indian businesses to generate export-ready invoices directly from Tally Prime while maintaining proper accounting, currency handling, and GST compliance.

It matters because:

- Export invoices must meet both accounting and regulatory needs

- Foreign currency accounting must remain accurate

- Cancellation and correction processes must be traceable

- GST reporting must stay consistent with invoice data

Using Tally as the central system helps keep export operations controlled and auditable.

Explore related services: Tally License services

3. How It Works (Simple Explanation)

With the correct setup:

- Sales invoice is created in Tally Prime

- Currency and exchange rate are applied for Nigeria transactions

- E-invoice is generated for export records

- Accounting and GST entries update automatically

- Any required cancellation or correction is recorded inside Tally

- Management reviews performance through reports and dashboards

The exporter works inside one system instead of juggling multiple tools.

Explore related services: Tally Customisation Services

4. 5-Step Implementation Process

1. Requirement Understanding

Business model, export volume, currency needs, GST structure, and reporting requirements are reviewed.

2. Planning & Integration

Invoice format, currency configuration, export compliance setup, and dashboard reporting are mapped.

3. Development & Testing

Invoice workflows, currency accounting, e-invoice generation, and cancellation procedures are tested with real scenarios.

4. User Training

Accounts and export teams are trained on invoice creation, cancellation rules, and reporting.

5. Ongoing Support & Optimisation

As export volume grows, performance, automation, and reporting are continuously refined.

Explore related services: Tally On Cloud services

5. Real-World SME Example

An Indian manufacturing exporter supplies components to clients in Nigeria.

Earlier, invoices were prepared manually and later entered into Tally for accounting and GST.

After implementing e-invoice from Tally Prime for Nigeria currency account, invoices are created once, currency values remain consistent, GST entries stay aligned, and cancellations are properly recorded.

Month-end reconciliation became easier and management gained clearer export visibility.

6. Realistic Business Benefits

- Accurate export invoicing

- Better currency tracking

- Improved GST alignment

- Reduced duplicate data entry

- Clear audit trail for corrections and cancellations

- Better financial visibility for management

Explore related services: Tally On Cloud services

7. Who It’s For & When to Consider Alternatives

Well suited for:

Indian exporters trading with Nigeria, manufacturing exporters, trading companies, and CA firms managing export clients.

May not suit:

Businesses with very low export volume or those not yet using structured accounting systems.

8. FAQ Section

- Can I generate e-invoice in Tally Prime for export?

Yes, export invoices can be created directly in Tally Prime with proper configuration. - How much is Tally ERP 9 in Nigeria?

Pricing varies by licence type and deployment. Exporters usually operate Tally from India while issuing invoices for Nigerian clients. - How can I cancel an e-invoice in Tally Prime after 24 hours?

Cancellation depends on regulatory rules and must be properly recorded in Tally with correct documentation. - What is the e-invoice cancellation process in Tally Prime?

Invoice is reversed or modified with audit trail while maintaining accounting integrity. - Is e-invoice cancellation linked to GST portal?

For Indian GST reporting, invoice records must remain aligned with GST filings and corrections.

9. How Pragyantra Helps

Pragyantra’s AI-powered dashboard connects export invoicing, accounting, GST, and reporting into one system.

Businesses gain real-time export visibility and reduced manual work.

Explore related blog article:

Tally Prime on Mobile: How to View Your Tally Data Live

Tally on Cloud for Indian SMEs: How It Works, Benefits & Real Use Cases

10. Soft CTA

If your export invoicing still involves multiple tools and manual tracking,

learn more about our solutions and explore how structured automation can simplify your workflow.

Pragyantra

Leave a comment

Your email address will not be published. Required fields are marked *